Recently, the American Plant Council (ABC) released a report on plant supplements for the U.S. market in 2019. The data was provided by the market research company SPINS&IRI and the Nutrition Business Journal (NBJ).

The overall situation of U.S. plant dietary supplement sales in 2019

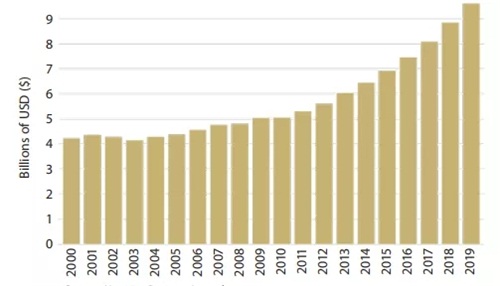

According to NBJ data, in 2019, the sales of plant dietary supplements in the United States continued to maintain strong growth, with total sales reaching 9.602 billion US dollars, an increase of 8.6% from 2018, and the growth rate was slightly lower than the 9.4% in 2018.

Table 1 & Table 2: 2000-2019 US plant dietary supplement sales

In addition to the increase in the total sales of plant dietary supplements, the total retail sales of all market channels increased in 2019. The strongest growth occurred in the direct sales channels of plant supplements (including online shopping, TV direct sales, etc.). Sales in 2019 were US$4.995 billion, a year-on-year increase of 11.5%; mass market retail (pharmacies, convenience stores, etc.) increased by 9.4% , Reaching 1.704 billion U.S. dollars; natural health food channels (including Whole Foods Supermarket, GNC and other brand specialty stores) sales were 2.904 billion U.S. dollars, a year-on-year increase of 3.6%.

Table 3: 2015-2019 US plant-based dietary supplement market retail sales

Sales in mainstream retail stores

Best-selling ingredients in mainstream retail stores

The First : Horehound

Among the best-selling herbal dietary supplements in mainstream retail stores in the United States, horehound (European solstice, Lamiaceae) has become the best-selling plant dietary supplement ingredient for the seventh consecutive year. In this channel, the total sales of horehound in 2019 reached an astonishing US$152,731,014, and still maintained a relatively high growth rate, an increase of 4.2% from 2018.

The record of horehound used to treat respiratory diseases can be traced back to the 1st century AD. This herb is still widely used due to its expectorant and cough properties. It usually appears in the form of antitussive and expectorant syrups and lozenges, equivalent to our country’s Chuanbei loquat cream can also be used to treat digestive diseases, such as stomach pain and intestinal worms.

Second place: Echinacea

Echinacea, known as the "Radix Isatidis" in Europe and the United States, still steadily occupies the second place, with total sales of US$120,185,303 in 2019, an increase of 4.9% from 2018. Echinacea can be used for medicinal purposes. It contains a variety of active ingredients that can stimulate the vitality of immune cells such as white blood cells in the human body. It has the effect of enhancing immunity. It can also be used to assist in the treatment of colds, coughs and upper respiratory tract infections. Chemical analysis shows that it contains at least three types of active ingredients, and because of its properties of inhibiting microorganisms and bacteria, it can also be used to treat skin diseases, candidiasis, and herpes viruses.

In addition, elderberry, turmeric, bilberry, ivy leaves, ginger, garlic, CBD, green tea, red yeast rice, apple cider vinegar, fenugreek, saw palmetto, black cohosh, barley grass, ginkgo, linseed, aloe, Yohimbe ranked 3-20. From the data point of view, the top three and sixth plant ingredients are all dietary supplements that relieve respiratory diseases and enhance immunity. It can be seen that the United States has a very high incidence of influenza diseases in 2019.

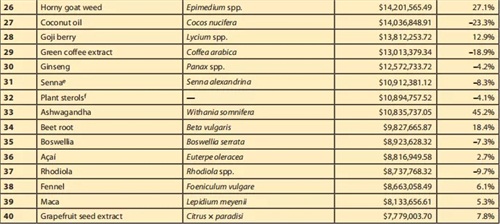

Table 4: The 40 best-selling ingredients in mainstream retail stores

The three fastest growing ingredients

The First: CBD

In 2019, CBD became one of the 40 best-selling ingredients in mainstream retail stores. In this channel, the total sales of CBD was US$35,899,378, ranking in the top ten, an explosive increase of 872.3% from 2018, the largest increase among all ingredients. In 2019, SPINS revised its CBD and cannabis data classification and began to include the sales of "full spectrum" cannabis extracts, resulting in a significant increase in the statistical sales of CBD products in mainstream channels.

CBD products currently mainly target anxiety, insomnia, pain relief and acne. The main health selling points of CBD products sold in mainstream channels in 2019 are ‘overall health", followed by emotional support and sleep promotion. The most common formula types for mainstream CBD products are ‘Alcohol-free tinctures, liquids and soft capsules‘.

According to the results of a survey of 4,000 people conducted by Consumer Reports in January 2019, it is estimated that 64 million American adults have tried CBD in the past two years. Among the people surveyed, the most common reasons for taking CBD are relaxation and reducing stress/anxiety, and 64% rated CBD as "very effective", and nearly a quarter of the respondents said they use CBD instead Over-the-counter (OTC) drugs (such as non-steroidal anti-inflammatory drugs) or conventional drugs (such as psychotropic drugs or painkillers).

At present, CBD regulations in the United States are very confusing. The FDA does not consider CBD as a legal dietary supplement ingredient. In 2019, the FDA sent 22 warning letters about illegally sold CBD products to relevant companies. At the same time, Virginia introduced a bill allowing hemp extracts to be used in food and beverages. However, it is clear that the chaotic regulatory mechanism has not hindered the further growth of the CBD market.

Second place: elderberry

Elderberry grew the second fastest among mainstream channels in 2019, and its sales continued to surge in the first half of 2020 due to the COVID-19 pandemic. Compared with 2018, elderberry sales increased by 110.8% to US$107,574,611, achieving a growth rate of more than 100% for two consecutive years and replacing turmeric as the third-ranked plant ingredient in mainstream sales.

The Centers for Disease Control and Prevention (CDC) predicts that at least 35.5 million people will be infected with the flu during the 2018-2019 flu season. This situation has stimulated elderberry sales. A large number of studies have proven that elderberry can reduce the symptoms of upper respiratory tract infections. For routine cases of the common cold and flu, it can be a safer alternative to prescription drugs. And easy-to-use features have also promoted the growth of elderberries. In recent years, consumers have increasingly sought non-pill supplement forms, such as gummies, liquids and tinctures. Elderberry has a berry flavor familiar to consumers and is particularly suitable for these types of formulas.

Third place: Ashwaganda

Ashwaganda is a commonly used herbal medicine in Ayurvedic medicine in India. It continued to maintain strong sales in 2019. Mainstream retail sales increased by 45.2% from 2018 to US$10,835,737. The effective ingredients of Ashwaganda have been extensively studied, and its active ingredient-Solantolide, similar to plant sterols, can protect the human body from the negative effects of stress. It can help the adrenal glands and nervous system and reduce the discomfort caused by stress. Studies have shown that Ashwaganda has anti-inflammatory, anti-tumor, anti-stress, anti-oxidation, immune regulation, hematopoietic and anti-aging properties. It also has a positive effect on endocrine, heart and lungs and central nervous system.

Several ingredients with a downward trend in sales

For many consumers, the understanding of Ayurvedic herbs may begin with turmeric. Turmeric was the fastest-growing ingredient in mainstream channels in 2017. Although turmeric sales are still growing in mainstream channels, they only increased in 2019 is 2.0%, much lower than 46.7% in 2017 and 30.5% in 2018. In addition, frankincense and fenugreek are two other traditional Ayurvedic ingredients, which also declined or increased slightly in 2019, to 7.3% and +2.3%, respectively. This may be because these ingredients are no longer ‘novel’ to consumers.

Garcinia cambogia, green tea and coconut oil are the three ingredients with the largest sales decline in the mainstream channel in 2019. A series of false propaganda lawsuits and negative news reports have caused consumers to question the safety and effectiveness of Garcinia Cambogia. It ranked only 24 in the mainstream channels in 2019, with sales totaling US$14,991,878, less than three of its sales in 2015. One part.

Natural channel sales

The top 20 plant supplements in natural channels are CBD, turmeric, elderberry, barley grass, Ashwaganda, aloe, linseed oil, mushrooms (others), echinacea, milk thistle, oregano, bilberry, sawdust Palm, Maca, Garlic, Valerian, Echinacea, Nigella, Horsetail, Chlorophyll/Chlorella.

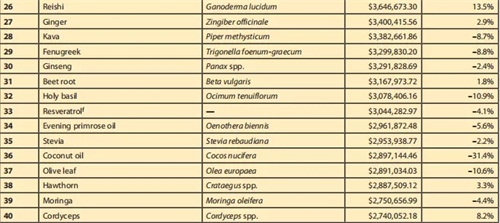

Table 5: The 40 ingredients with the highest sales from natural channels in the United States

CBD has become the best-selling plant ingredient in the natural channel for the second consecutive year, with total sales of US$90,720,546, an increase of 71.3% compared to 2018, and it is the fastest growing ingredient in this channel in 2019.

Mushrooms are the second fastest growing ingredient in natural channels in 2019. This category includes Hericium erinaceus and Yunzhi, which increased by 33.2% compared to 2018, totaling US$10,596,345. In addition, the sales of Lingzhi and Cordyceps increased by 13.5% and 8.2% respectively. Immunity and cognitive health are the main selling points of mushrooms in natural channels. Capsules and powders are the most common dosage forms of mushroom supplements. Consumers have begun to realize the potential health benefits of fungi.

Coconut oil was the ingredient with the largest decline in natural channel sales in 2019, totaling US$2,897,144, a decrease of 31.4% from 2018. In 2013, after Dr. Oz hyped up the potential health benefits of this ‘miracle fat for weight loss’, coconut oil achieved rapid sales growth in 2013. Later, because of the polarization in the United States, the evaluation showed a downward trend.

Summary

According to the 2019 survey of the Responsible Committee, the consumption of dietary supplements by American adults reached the highest level in history in 2019. At the same time, half of consumers are taking plant dietary supplements, and nearly 72% of adults said they are concerned about plant supplements. Confidence in its safety and effectiveness.

Because of the COVID-19 outbreak, ABC predicts that in 2020, the annual sales growth rate of the entire plant dietary supplement market will achieve historic growth, especially for immune health ingredients, including elderberry and echinacea. In addition, there are also great opportunities in the medicinal mushroom market. Some of the mushroom ingredients will increase sales by as much as 70% in the first half of 2020.

Original link :https://www.21food.com/news/detail75158.html